- Industrial display

-

Industrial Products

- DC Servo Drive

- AC Servo Drive

- Industrial board

- Siemens

- Switch Sensor

- Proximity Switch

- Temperature Controller

- Protection Relay

- Fiber Optic Sensor

- Encoder

- Fan

- other

- Heidelberg

- MITSUBISHI

- FANUC

- Siemens adapter

- Fujitsu connector

- Motherboard

- Board

- Contactor

- Circuit

- OMRON

- Relay

- Motor Driver

- power supply

- Cable

- Transformer

- HMI Touch Glass

-

HMI Full Machine Whole unit

- OMRON HMI Touch Panel

- Siemens HMI Touch Panel

- Mitsubishi HMI Touch Panel

- Allen-Bradley automation HMI Touch Panel

- DELTA HMI Touch Panel

- Proface HMI Touch Panel

- KINCO DELTA HMI Touch Panel

- HITECH HMI Touch Panel

- WEINTEK HMI Touch Panel

- TECVIEW HMI Touch Panel

- WEINVIEW HMI Touch Panel

- PANASONIC HMI Touch Panel

- KYOCERA HMI Touch Panel

- SCHNEIDER HMI Touch Panel

- Module

- lcd inverter

- Membrane Keypad Switch

- Zhiyan Customized Touch Screens

- Frequency Inverter

- Servo Motor

- PLC

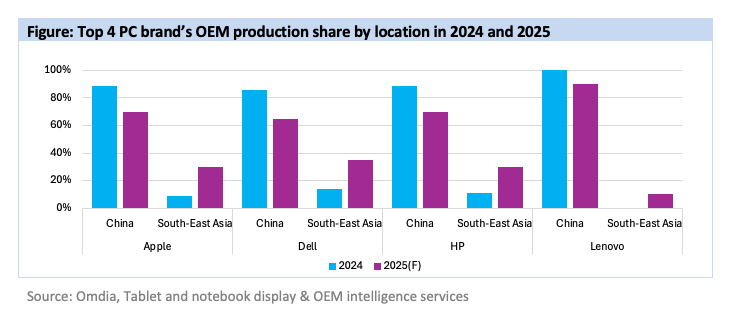

The global PC supply chain is undergoing structural adjustments, and production activities in Southeast Asia have significantly increased. In the past, China has long accounted for more than 80% of the world's PC production with its mature and complete industrial chain. However, the latest trade situation has forced OEMs and brand owners to re-evaluate their cost and risk management strategies.

After the new US government took office in February 2025, a series of tariff policies impacted global trade flows, especially Sino-US bilateral trade. In April of the same year, the United States proposed to raise tariffs on Chinese goods from 11.4% to 145%. China immediately announced that it would impose tariffs of up to 125% on US imports, causing shocks in the international market. The turning point came when the two sides agreed to a 90-day tariff exemption period to buy buffer time for negotiations. During this period, the United States reduced its tariff rate to 30% and China's tariff rate to 10%.

In order to avoid the possible cost increases caused by future tariff risks, major US PC brands have begun to promote the diversification of production bases. Dell and HP launched the migration plan of production lines outside China as early as 2023, and Apple and Microsoft subsequently realized production capacity through Vietnam foundries in 2024. This strategic adjustment has made Southeast Asia gradually become a core hub for PC assembly, especially a key node for supplying the North American market.

According to Omdia's latest "Tablet and Notebook Display and OEM Market Intelligence" data, the world's four largest PC brands are planning to cut OEM orders in China while increasing production capacity in Southeast Asia. The region's share of global PC OEM production is expected to increase from an average of 15% in 2024 to 25%-30% in 2025, reflecting the strategic intention of brands to continue to promote regional diversification to optimize business continuity. Looking ahead, the global PC supply chain may continue to diverge - China's production capacity will still focus on non-US markets, while Southeast Asia is emerging as the main production base for North American-oriented models. Despite the strong development momentum, Southeast Asia's PC manufacturing ecosystem is still in the cultivation stage: key components in the region still need to be imported from China, and cross-border logistics costs remain high. Although the labor cost advantage is significant, the overall manufacturing cost in Southeast Asia is still higher than that in China in the short term, considering factors such as logistics and infrastructure. Against this backdrop, brand owners are adopting a gradual strategy: initially, low-end price-sensitive PC models will be transferred to new production lines in Southeast Asia. With the increase in local investment and capacity upgrades, the proportion of mid-to-high-end models produced in Southeast Asia is expected to gradually increase.